Cannabis Banking & Payments: 10 Key Predictions for 2026

The Definitive Outlook for Operators, MSOs, and Ancillary Businesses

Quick-Look Summary – 10 Predictions at a Glance

- Schedule III rescheduling will NOT be finalized in 2026

- Federal SAFE Banking dies again; state-level protections surge

- Pay-by-Bank becomes the default checkout for delivery + e-commerce

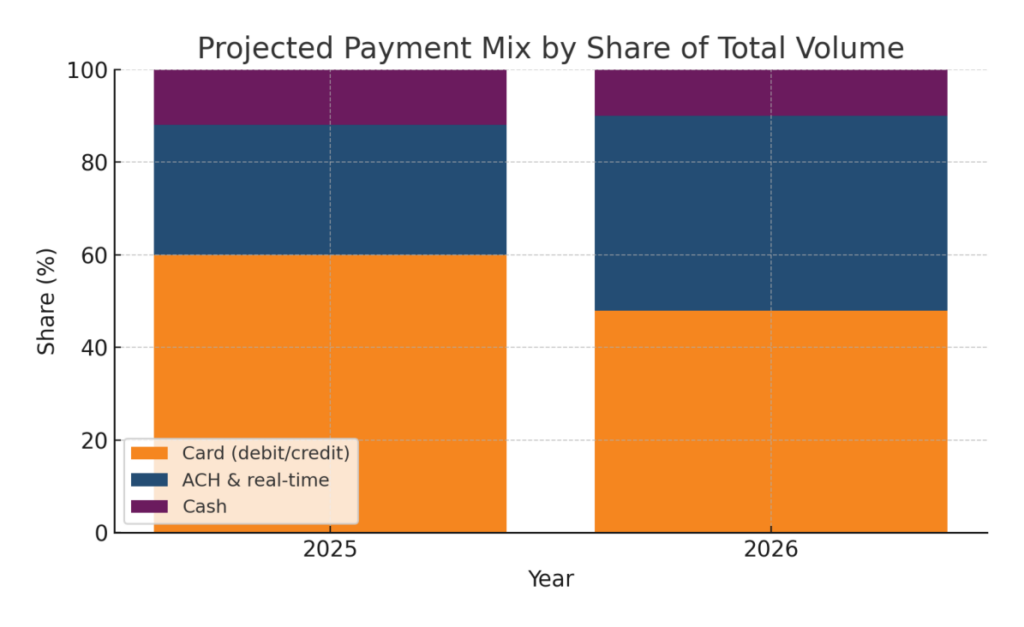

- ACH & real-time payments reach 42% of transaction volume

- Stablecoin payroll becomes common for ancillary businesses

- Banking-as-a-Service platforms onboard 3,000+ new accounts

- Delivery + e-commerce surpass 28% of total sales

- Cannabis-specific Buy-Now-Pay-Later launches in 4 states

- Fraud & chargeback rates fall ~35% thanks to AI tools

- Lending gap grows to $18–22 billion

Introduction

2025 ends with U.S. legal cannabis sales approaching $35–37 billion in direct annual revenue, even as operators remain boxed in by federal prohibition.[1]

Below are the 10 trends we expect to define cannabis banking and payments in 2026, based on late-2025 market reporting and current regulatory timelines.

The 10 Predictions for 2026

1. Schedule III Rescheduling Will NOT Be Finalized in 2026

The DEA’s rescheduling process continues through hearings and administrative steps, and cannabis remains Schedule I today.[2] Given typical Controlled Substances Act timelines and the current delay pattern, a fully effective Schedule III final rule is unlikely to be completed and operational across 2026, keeping 280E tax treatment in place for most plant-touching businesses for the bulk of the year.[2]

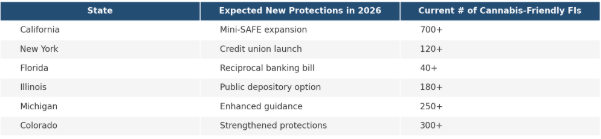

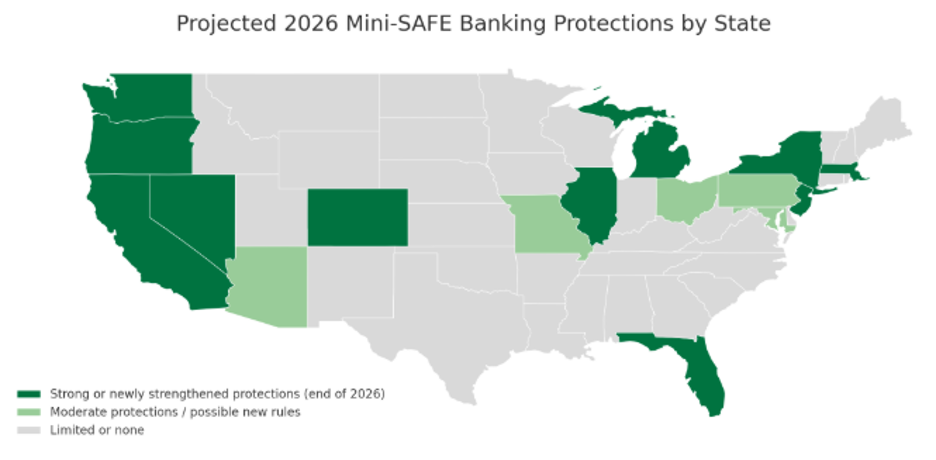

2. Federal SAFE Banking Dies Again – State-Level Protections Explode

Federal cannabis banking reform remains stalled heading into 2026, despite renewed pushes and broad coalition support.[3] As Washington drags, state legislatures continue filling the gap, expanding mini-SAFE frameworks, public-banking or credit-union models, and safe-harbor guidance for in-state institutions serving cannabis.[4]

Implication: Banking access improves unevenly, and state policy becomes the real near-term driver of payments reliability.

3. Pay-by-Bank Becomes the Default Checkout for Delivery + E-Commerce

As delivery and online ordering grow, account-to-account pay-by-bank checkout becomes the most reliable compliant cashless method because it avoids card-network exposure. U.S. regulators and central-bank researchers describe pay-by-bank (account-to-account) as a fast-growing merchant payments use case, supported by open-banking access and instant-payments rails.[5][6]

Expect rapid scaling of:

- “Connect your bank → approve payment” checkout flows

- Instant account verification

- Loyalty incentives that steer repeat buyers into pay-by-bank

Implication: In 2026, digital conversion advantage comes from checkout simplicity, not fragile card substitutes.

4. ACH & Real-Time Payments Hit 42% of Total Transaction Volume

Pin-debit, same-day ACH, and real-time settlement rails are projected to push non-card cannabis payments from roughly ~28% of volume in 2025 to ~42% in 2026, with pay-by-bank acting as the accelerant for delivery and e-commerce orders.[7]

Breakdown of projected payment methods by share of total volume. Source: Headset & BDSA (projected).

ACH growth also intersects with tighter ACH fraud/return controls rolling through 2025–26, raising the stakes on compliance discipline.[8]

5. Stablecoin Payroll Becomes Common for Ancillary Businesses

Stablecoins are increasingly used for payroll and contractor settlement in high-risk and globally distributed industries, with 2025 surveys showing meaningful growth in stablecoin compensation adoption.[9]

Implication: Expect stablecoins first in payroll and vendor payments, then broader B2B settlement.

6. Banking-as-a-Service Platforms Onboard 3,000+ New Cannabis Accounts

Traditional financial institutions remain cautious, but fintech-bank BaaS programs keep scaling nationally. With state-level protections expanding and open-banking access improving, 2026 should see thousands of new cannabis-related accounts onboarded through programmatic BaaS partnerships, outpacing legacy onboarding alone.[6][4]

Implication: Access improves, but durability matters — operators need partners with real compliance depth.

7. Delivery & E-Commerce Surpass 28% of Total Sales

Delivery and app-based ordering remain one of the strongest structural growth vectors in cannabis. Market forecasts show delivery services expanding rapidly through 2026 as consumer habits shift and digital ordering becomes routine.[10]

Implication: The faster digital sales grow, the more pay-by-bank and real-time rails become the category default.

8. Cannabis-Specific Buy-Now-Pay-Later Launches in 4 States

BNPL is already entering cannabis via specialized credit platforms serving the supply chain, and major industry/banking media view this as an early category signal for wider rollout into consumer markets.[11][12]

In 2026, expect consumer-side BNPL pilots in early-adopter adult-use markets such as California and Michigan.

Implication: BNPL becomes a basket-size lever for premium SKUs and loyalty segments, especially online and delivery.

9. Fraud & Chargeback Rates Fall ~35% Thanks to AI Tools

High-risk processors are scaling AI fraud stacks — velocity checks, device fingerprinting, adaptive risk scoring, and stronger KYC — and industry fraud reporting shows these tools reducing digital-payments fraud materially.[13][14]

Implication: Fraud tooling isn’t optional anymore; it’s measurable margin protection.

10. Total Lending Gap Grows to $18–22 Billion

Federal illegality still blocks conventional bank lending. With private credit tightening and a wave of cannabis debt coming due through 2026, the lending shortfall widens further.[15][16] At the same time, long-range growth-capital needs remain massive over the next decade.[17]

Implication: Capital stays expensive and selective, reinforcing why lower-cost, faster-settling payment rails matter for cash flow.

2026 State-by-State Banking Outlook

States expected to add protections (dark green = new in 2026; light green = existing).

FAQ – Cannabis Banking & Payments 2026

Q: Will cannabis businesses get 280E relief in 2026?

A: Unlikely before late-2026 at the earliest, since rescheduling is still unfinished.[2]

Q: Which payment method will grow the fastest in 2026?

A: Pay-by-bank plus ACH/real-time rails are projected to lead growth as delivery and e-commerce expand.[5][7][10]

Q: Can cannabis companies get traditional bank loans in 2026?

A: Still extremely limited; most capital continues via private credit and revenue-based lenders.[15][16]

Footnotes / Sources

- 2025 U.S. legal cannabis direct sales estimate (~$35B).

Highly Capitalized (industry/market media): https://highlycapitalized.com/us-cannabis-industry-poised-to-top-123-billion-economic-impact-in-2025/ First Citizens Bank - DEA Schedule III rescheduling timeline + hearing delays.

Marijuana Moment (policy media): https://www.marijuanamoment.net/dea-schedules-hearing-on-marijuana-rescheduling-proposal-delaying-final-rule/ RiseWorks

Reuters (mainstream): https://www.reuters.com/legal/litigation/cannabis-trump-20-2025-beyond-2025-01-09/ The Washington Post - SAFE/SAFER Banking remains stalled federally.

Congressional Research Service: https://www.congress.gov/crs-product/LSB11076 BTCC

Reuters (mainstream): https://www.reuters.com/legal/litigation/cannabis-trump-20-2025-beyond-2025-01-09/ The Washington Post - States expanding cannabis-banking protections.

NCSL tracker (government/non-profit policy): https://www.ncsl.org/research/financial-services-and-commerce/cannabis-financial-services The Paypers - Pay-by-bank/open-banking merchant payments trend in the U.S.

Federal Reserve FEDS Notes (central bank research): https://www.federalreserve.gov/econres/notes/feds-notes/pay-by-bank-and-the-merchant-payments-use-case-benefits-20250707.html Federal Reserve - Open-banking access and bank-fintech A2A/payment-data ecosystem scaling.

Reuters (mainstream): https://www.reuters.com/sustainability/boards-policy-regulation/jpmorgan-secures-deals-with-fintech-aggregators-over-fees-access-data-cnbc-2025-11-14/ Reuters - Cannabis payment-mix shift toward non-card rails (projection).

Headset & BDSA market/analytics reporting (data firms): https://www.headset.io/industry-reports and https://bdsa.com/cannabis-insights BDSA+1 - Nacha ACH fraud/return-risk rules tightening into 2026.

CannabisRegulations.ai (regulatory analysis, not a payments provider): https://www.cannabisregulations.ai/cannabis-and-hemp-regulations-compliance-ai-blog/nacha-2025-2026-fraud-rules-hemp-thc - Stablecoin payroll adoption trend (survey/reporting).

Coinspice (crypto trade media): https://coinspice.io/research/stablecoin-crypto-payroll-trends/ Coinspice - Delivery/e-commerce expansion through 2026.

DataHorizzon Research (market research): https://datahorizzonresearch.com/cannabis-delivery-service-market-46820

Business Research Insights (market research): https://www.businessresearchinsights.com/market-reports/cannabis-delivery-service-market-116624 - Cannabis BNPL category signal (media coverage, not provider sites).

Banking Dive (industry media): https://www.bankingdive.com/news/fundcanna-launches-bnpl-tool-cannabis-businesses/758225/ Federal Reserve

Cannabis Business Times (trade media): https://www.cannabisbusinesstimes.com/vendor-news/news/15753340/fundcanna-launches-readypaid-the-1st-automated-b2b-buy-now-pay-later-platform-for-the-cannabis-industry www.redfernhempco.com - Broader BNPL consumer growth context.

Washington Post (mainstream): https://www.washingtonpost.com/business/2025/12/02/holiday-shopping-bnpl-inflation/ The Washington Post - AI fraud tools reducing fraud/chargebacks.

Merchant Risk Council 2025 Global Fraud & Payments Report (industry non-profit): https://info.merchantriskcouncil.org/hubfs/Documents/Reports/Fraud%20Reports/2025_Global_Fraud_and_Payments_Report.pdf - Payments AI fraud reduction and controls.

KPMG research: https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2025/fighting-fraud-payments-ai.pdf - Debt wall/maturities through 2026.

MJBizDaily (trade media): https://mjbizdaily.com/cannabis-debt-crisis-looms-as-billions-in-loans-come-due-in-2026/ - Private lenders tightening in cannabis.

Wall Street Journal (mainstream): https://www.wsj.com/articles/cannabis-buzz-is-wearing-off-for-industrys-private-lenders-e9909d1f - Long-range growth-capital need.

Marijuana Herald (trade media): https://themarijuanaherald.com/2024/10/report-us-cannabis-industry-needs-up-to-130-billion-to-grow-offering-2-4-billion-in-potential-interest-for-banks/