2025 Cannabis Industry Statistics & Data Insights

How the cannabis industry is performing — and where it’s headed next.

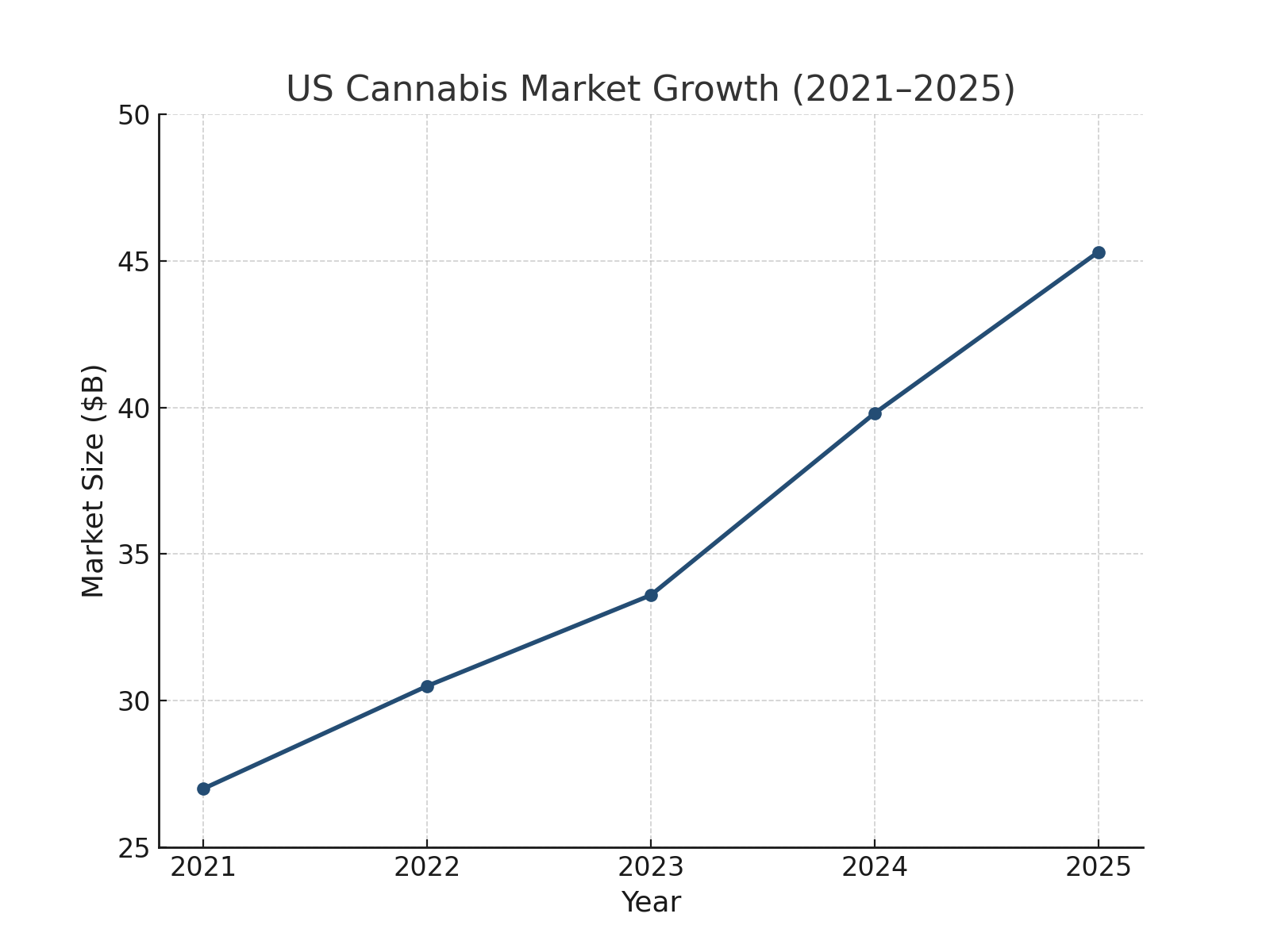

1. Market Size & Growth Trajectory

U.S. Market

The U.S. legal cannabis market is projected to reach $45.3 billion in 2025, growing from $33.6 billion in 2023 (Statista).

Annual growth is expected to continue at an average CAGR of 11–12% through 2030 (Grand View Research).

Global Market

Globally, the cannabis industry was valued at $57 billion in 2023 and could exceed $444 billion by 2030, based on high-end projections (Prohibition Partners).

Other forecasts estimate the global legal market will reach $230–290 billion by 2033, at a 24–34% CAGR (IMARC Group).

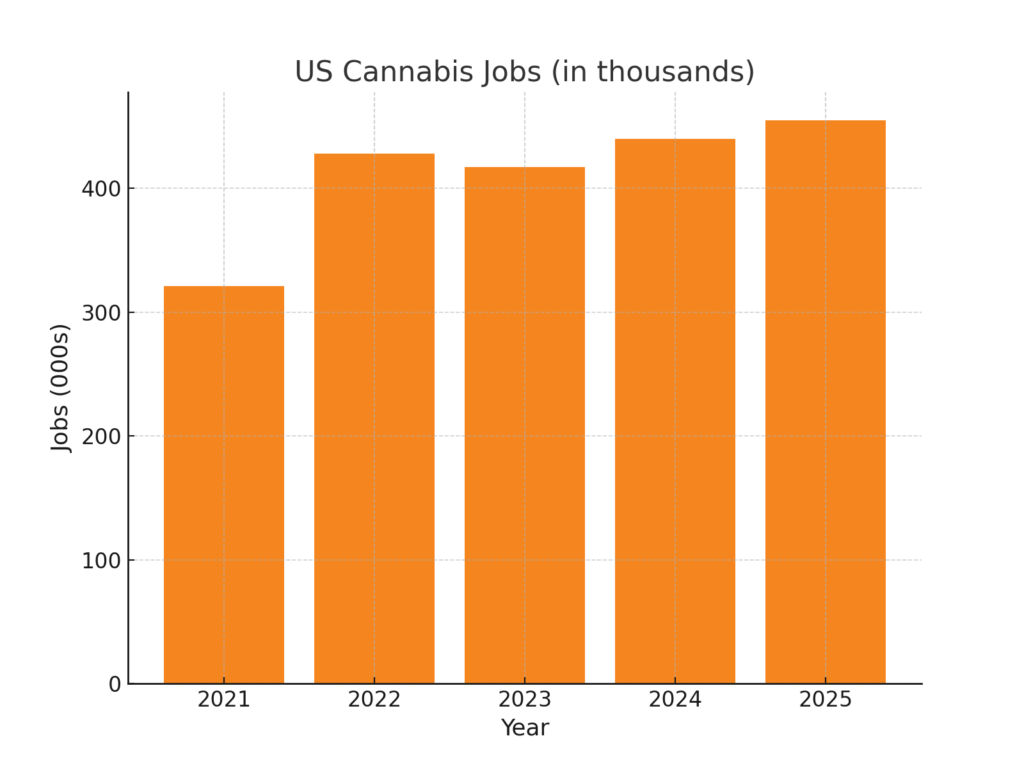

2. Economic Impact & Employment

The U.S. cannabis sector contributed $115.2 billion to the economy in 2024, and is forecasted to hit $123.6 billion in 2025 (MJBiz Factbook).

Cannabis supports 440,445 full-time equivalent jobs, making it a top job creator in newly legal states (Leafly Jobs Report).

Annual state tax revenues from cannabis exceed $20 billion, outpacing revenue from alcohol in several states (Marijuana Policy Project).

3. Consumer Behavior & Demographics

47% of Americans have used cannabis, and over 68% support full legalization (Gallup).

Millennials and Gen Z account for more than 60% of cannabis purchases, with Gen Z purchases growing 3% year-over-year (Headset Analytics).

1 in 3 women now consume cannabis, particularly in the form of edibles and infused products (Brightfield Group).

Online ordering and delivery continue to surge—global cannabis delivery services are projected to grow from $2.95 billion in 2023 to $18.65 billion by 2033 (20% CAGR from 2025–33), driven in part by post‑COVID e‑commerce shifts .

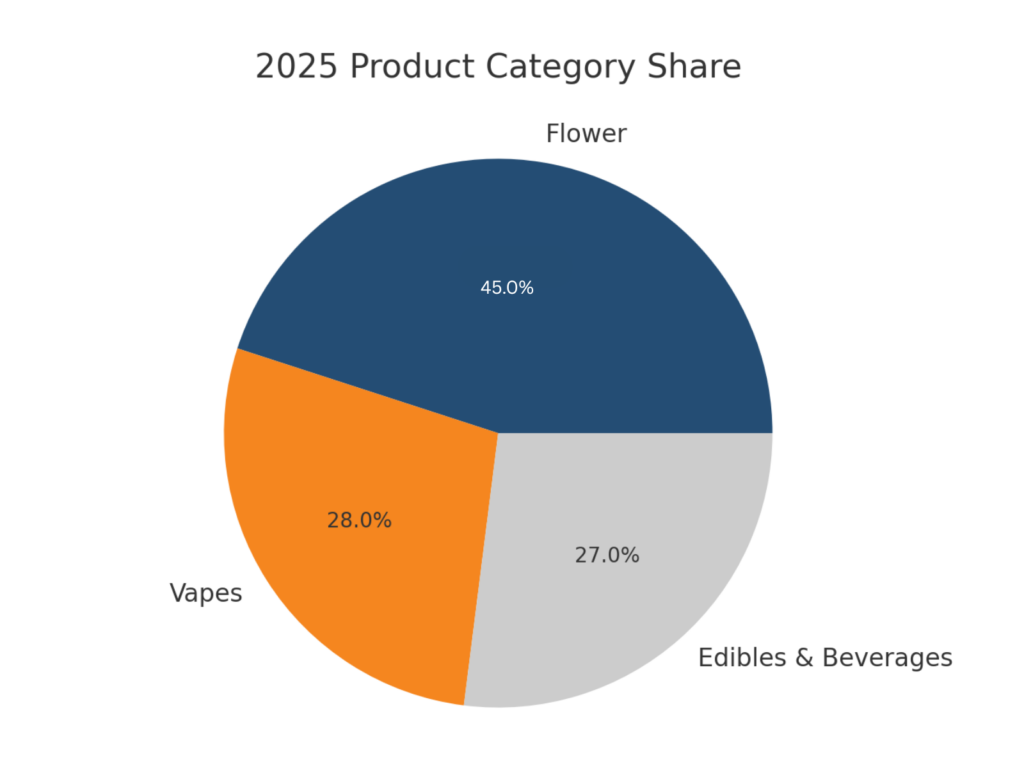

4. Pricing, Products & Regional Trends

Since 2021, average retail cannabis prices have fallen by 32%, with price drops driven by overproduction and increased competition (Cannabis Benchmarks).

In New York, as dispensaries expanded from 41 to over 300 by mid-2025, prices dropped: flower by 5%, vapes by 15%, edibles by 14% (NY Office of Cannabis Management).

Product breakdown:

– Flower: 45% of market sales

– Vapes: ~28%

– Edibles/Beverages: 27%

Cannabis beverages are booming—sales increased 79–112% year-over-year in states like Michigan, Illinois, and Ohio (MJBizDaily, Headset).

5. Legalization & Regulatory Trends

24 states have legalized adult-use cannabis, and 79% of Americans now live in a state with legal access (NORML).

New York is on track to exceed 625 licensed retailers by the end of 2025 (NY OCM).

The DEA is considering rescheduling cannabis from Schedule I to Schedule III, a move that would alleviate 280E tax burdens but not legalize banking or interstate commerce (Federal Register Notice).

Experiential regulations are expanding: California’s AB 1775 enables cannabis cafés, paving the way for social consumption lounges (California NORML).

6. Key Industry Challenges

Access to banking services remains a top challenge; most cannabis businesses operate in cash or rely on third-party workarounds due to lack of federal clarity (NCIA).

Federal reform has stalled: SAFE Banking Act and broader legalization bills continue to face delays in Congress (Congress.gov).

Cannabis operators carry over $2.5 billion in debt, and only 27% of companies reported profitability in 2024, down from 42% in 2022 (MJBizDaily).

Investor interest has cooled: venture capital in cannabis dropped from $3B in 2019 to just $410M in 2024, with debt now accounting for the majority of funding (Viridian Capital).

Environmental concerns are mounting: indoor cultivation consumes nearly 1% of U.S. electricity, more than all data centers or cryptocurrency mining (Washington Post).

7. Innovation & Emerging Trends

Cannabis-infused beverages are the fastest-growing segment, outperforming other categories in consumer trial and growth.

AI and automation are improving everything from:

– Crop yield forecasting

– Compliance workflows

– Inventory and dynamic pricing

– Customer segmentation and loyalty programs (Cannabis Business Times).

E-commerce and digital loyalty tools have become table stakes for dispensary competitiveness (Springbig).

Sustainability is gaining focus: brands are exploring low-energy LED grows, biodegradable packaging, and water conservation techniques (Leafly).

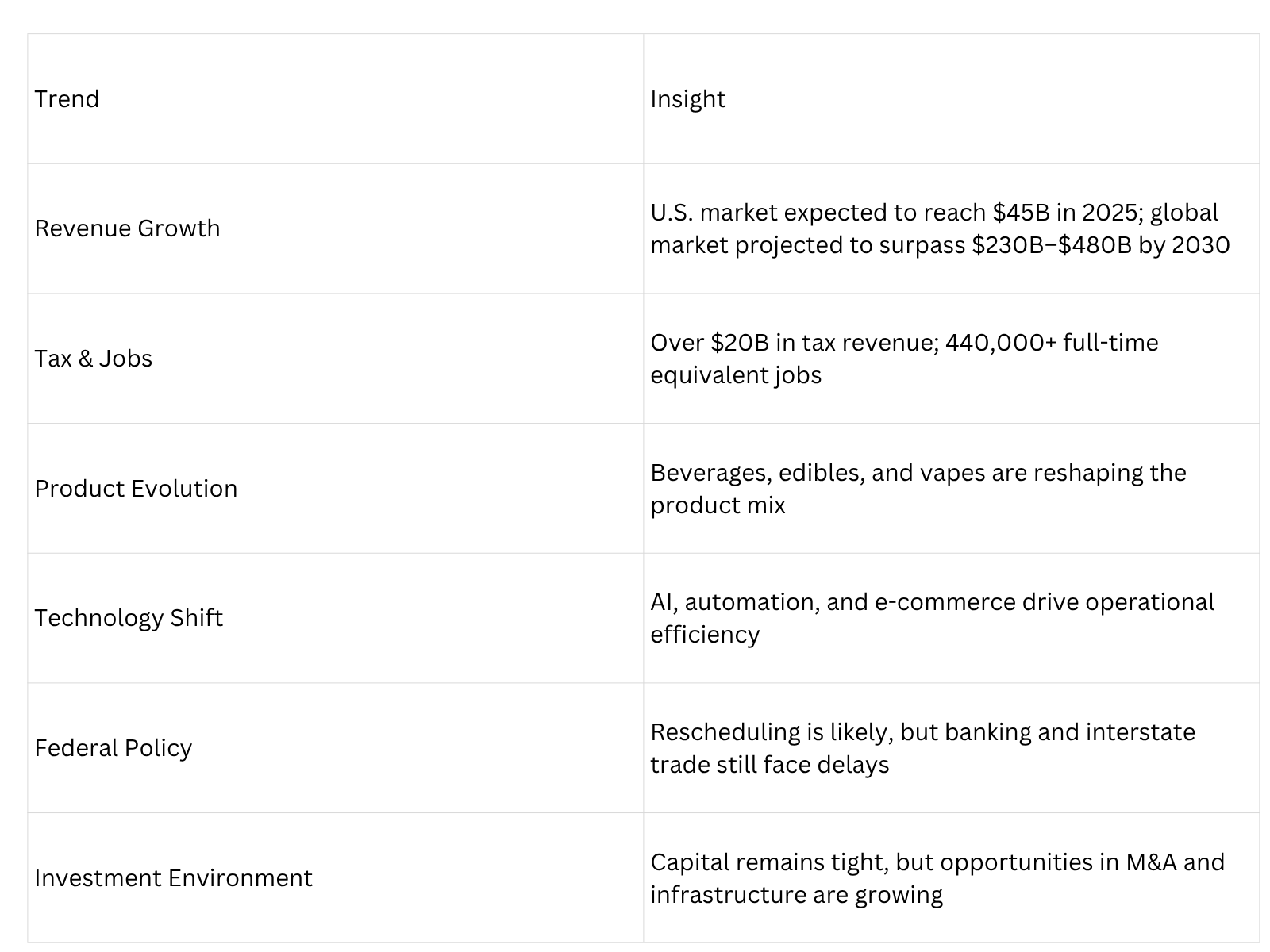

8. 2025 Forecast & Strategic Outlook

9. Paybotic Financial’s Role in a Changing Landscape

Digital Payments: As more consumers demand card and digital options, Paybotic Financial enables secure, compliant, cashless checkout.

Banking Services: We offer cannabis businesses access to stable, transparent banking relationships—critical for long-term viability.

Data & Compliance: Tools that help dispensaries monitor transactions, manage taxes, and remain compliant with local and federal regulations.

E-commerce Support: Payment infrastructure that powers online ordering, delivery, and loyalty integration.

Growth Enablement: Whether launching a new location or scaling operations across state lines, Paybotic Financial is your financial partner at every stage.

Final Takeaway

The cannabis industry in 2025 is becoming more regulated, more competitive, and more consumer-driven. While the promise of federal reform remains uncertain, clear opportunities are emerging for innovative operators focused on efficiency, differentiation, and transparency.

Paybotic Financial is positioned to support that evolution—delivering the financial services, infrastructure, and insight that cannabis businesses need to thrive.